mICHAEL G. MUSTAINI've been in the insurance industry since 1977. I've done thousands of quotes and continue even today. We are not an internet sales office, I believe every sale should be across the desk with personal service. ArchivesCategories |

Back to Blog

FULL COVERAGE or NOT?7/16/2018 DO YOU REALLY HAVE FULL COVERAGE CAR INSURANCE?

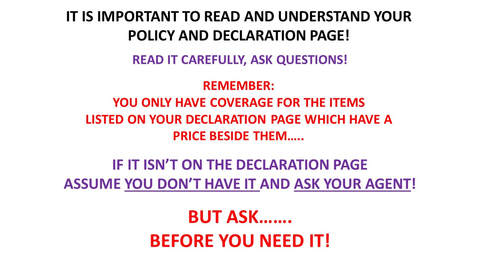

Frequently people will say they have “full coverage” or want a quote for “full coverage”. In a industry that is word intensive, laden with definitions, exclusions, deductibles, limits, and inside limitations these two words are most troubling and misunderstood. Allow me to explain, having started in the insurance industry in 1978 I’ve heard these words all to frequently. Car dealers, finance companies and banks require “full coverage” but insurance companies don’t sell it. Many will say: “I want the cheapest full coverage but nothing else”. Or they will reject all offered optional coverages and then say: “I thought I had full coverage, the bank said I did”. That term “full coverage” is a bank or finance company term which, in their industry, refers to Comprehensive and Collision. (I guess two words are easier to say than three!) These two coverages only provide physical damage coverage for the specified vehicle, minus depreciation and the deductible. However, in the insurance industry and legally, the term “FULL COVERAGE” is an impossible definition to rise to. The problem lies in the general public’s mistaken interpretation of that term. (It’s vague and non-specific, insurance policies are specific and well defined.) In effect they claim, mistakenly, more coverage than specified and delineated in the contract. The banks and finance companies are causing a great deal of confusion by propagating these terms. It is confusing people and a great disservice to their customer. Insurance companies do sell Comprehensive and Collision coverages which are clearly specified and well defined in the contract. Companies also sell the optional coverages: Rental Reimbursement, Roadside Assistance, Uninsured Motorist and Underinsured Motorist coverages to name a few. Liability coverages in various top limit amounts, all of which are specified in the auto contract, purchased at an additional price and delineated on the declaration page. Seek out your insurance agent’s advice regarding your specific coverages and what exactly you do and do not have. Ask them to explain what limits and coverages you have? Purchase, at a minimum, enough liability limits to at least cover your assets. If you don’t have an agent or feel uncomfortable or uncertain about your coverages, give us a call or stop in. We’ll be glad to help! If your agent hasn’t explained these coverages, they should, we do! Mike & Tammy Mustain Mustain’s Insurance [email protected] 812-282-4111

0 Comments

Read More

Back to Blog

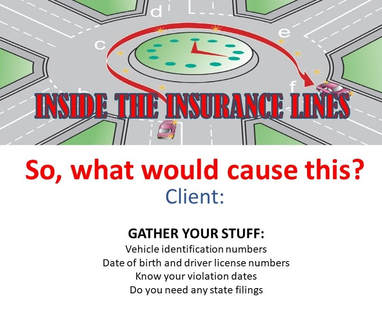

The Quote Process5/30/2018 Some items you will need to have handy when calling for an insurance quote:

1) Names, addresses, dates of birth and driving records of all drivers. 2) Vehicle identification numbers for all vehicles. 3) If you have current insurance: a) What are the liability limits b) How long have you been insured, and have you had any lapses in coverage. 4) Any other non-driving residents in the household. 5) Is there a loan on any vehicle. It is critical that you compare coverage between what you have and what you are being quoted. Some agents will quote less coverage to make it appear a better price. Understand this, you must be upfront and honest with your agent or prospective agent when getting an insurance quote. Any attempt to hide or non-disclose tickets, accidents, driving records and/or operators will (or can) void coverage. Whether it is our agency you call for a quote or another, the above generalizations will apply. |

RSS Feed

RSS Feed